Mining is evolving faster than ever.

What was once an industry defined by physical muscle — haul trucks, crushers, conveyors — is now being transformed by data intelligence, digital modelling, and real-time insight.

At the heart of this transformation lies a quiet revolution: 3D scanning.

Once used primarily for design verification or plant modification, scanning is now the gateway technology that feeds the emerging world of digital twins — live, data-driven replicas of mine assets that help engineers predict, plan, and optimise before problems occur.

At Hamilton By Design, we’ve spent years scanning and modelling chutes, hoppers, and material-handling systems across Australia’s mining sector. Each project has shown us one thing clearly:

Scanning isn’t just about geometry — it’s about knowledge.

And digital twins are the next logical step in turning that knowledge into action.

What Exactly Is a Digital Twin?

Think of a digital twin as the digital counterpart of a physical asset — a chute, a conveyor, a processing plant, even an entire mine site.

It’s not a static 3D model; it’s a dynamic, data-linked environment that mirrors the real system in near real time.

Sensors feed performance data into the twin: wear rates, temperature, vibration, flow speed, throughput. The twin then responds, updating its state and allowing engineers to simulate scenarios, forecast failures, and test design changes before touching the physical equipment.

In essence, a digital twin gives you a real-time window into the life of your assets — one that’s predictive, not reactive.

How 3D Scanning Powers the Digital Twin

To create a digital twin, you first need an accurate foundation — and that’s where 3D scanning comes in.

The twin can only be as good as the geometry beneath it.

Laser scanning or LiDAR technology captures millimetre-accurate measurements of chutes, hoppers, crushers, conveyors, and processing structures.

This creates a precise 3D “as-is” model — not what the plant was designed to be, but what it actually is after years of wear, repair, and modification.

That baseline geometry is then aligned with:

- Operational data from sensors and PLCs (e.g. flow rates, temperatures, vibrations)

- Material behaviour data from CFD and wear simulations

- Design intent data from CAD and engineering archives

Once these layers are synchronised, the model becomes a living system — continuously updated, measurable, and comparable to its physical twin.

You can see how we capture and prepare that foundation in our detailed article:

3D Scanning Chutes, Hoppers & Mining

From Reactive Maintenance to Predictive Performance

In most operations today, maintenance still works on a reactive cycle — wait for a fault, shut down, repair, restart.

It’s expensive, unpredictable, and risky.

With digital twins, that model flips.

Instead of waiting for wear to become a failure, the twin uses real-time and historical data to forecast when parts will reach their limits.

The result is predictive maintenance — planning shutdowns based on evidence, not emergency.

Imagine being able to simulate how a chute will behave under new flow conditions, or when a liner will reach its critical wear thickness, before you commit to a shutdown.

That’s not future-speak — it’s what forward-thinking operators are doing right now.

Every hour of avoided downtime can mean tens or even hundreds of thousands of dollars saved.

Even a modest 5 % reduction in unplanned outages can add millions to annual output.

Integrating Scanning, Simulation, and Sensors

A full digital-twin workflow in mining usually includes four steps:

- Capture: 3D scanning provides the exact geometry of the asset.

- Model: Engineers integrate the geometry with CAD, CFD, and FEA models.

- Connect: Real-time data from sensors is linked to the model.

- Predict: Algorithms and engineers analyse the twin to predict future performance.

The power lies in connection.

Each new scan or dataset strengthens the model, improving its predictive accuracy. Over time, the digital twin evolves into a decision-support system for engineers, planners, and maintenance teams.

Real-World Applications Across the Mining Value Chain

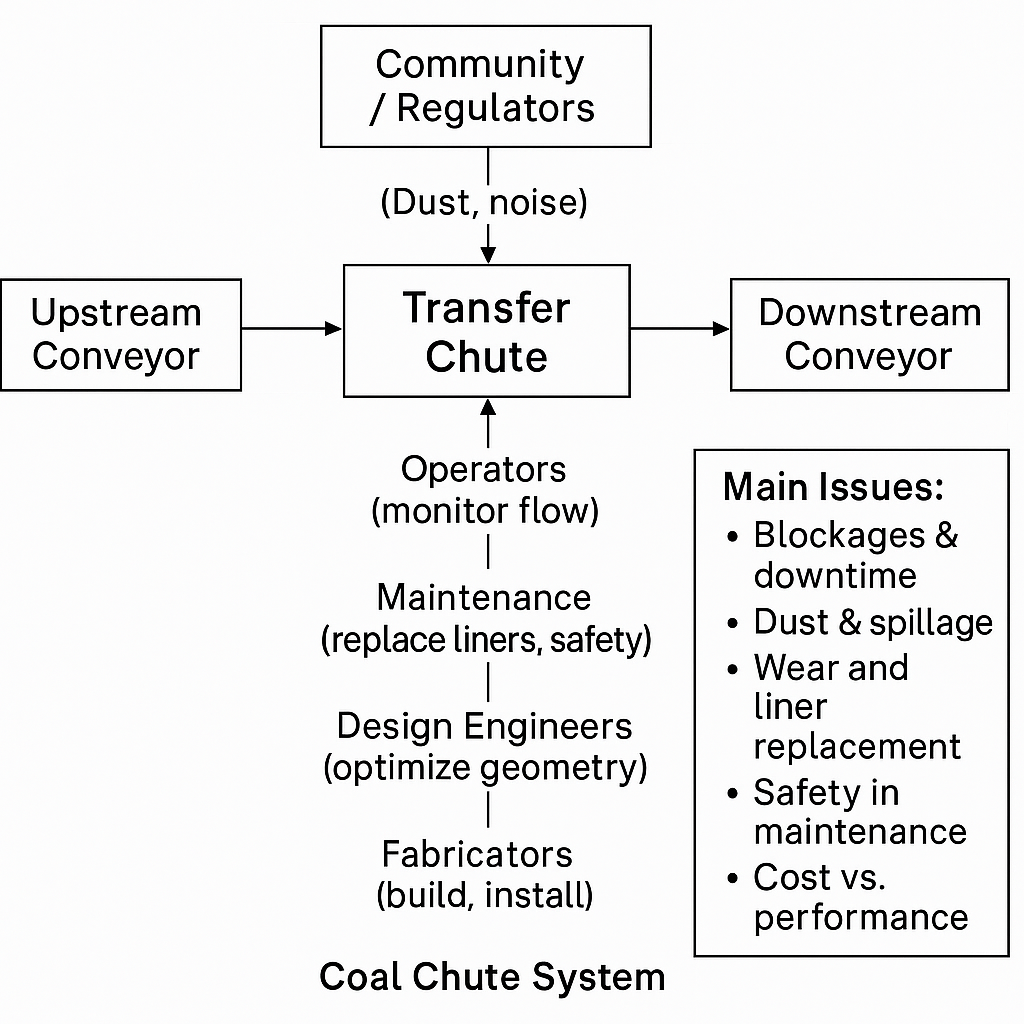

1. Chute & Hopper Optimisation

Flow issues, blockages, and uneven wear can be modelled digitally before modifications are made.

This reduces trial-and-error shutdowns and improves throughput reliability.

2. Conveyor Alignment

Scanning allows engineers to identify misalignment over kilometres of belting.

A digital twin can then simulate tracking and tension to prevent belt failures.

3. Crusher and Mill Wear

By combining periodic scans with wear sensors, operators can visualise material loss and forecast replacement schedules.

4. Structural Monitoring

3D scanning enables long-term comparison between “as-built” and “as-maintained” geometry, detecting distortion or settlement early.

Each of these applications reinforces a core insight:

The line between mechanical engineering and data engineering is disappearing.

Why Digital Twins Matter for Australia’s Mining Future

Australia’s competitive advantage has always been resource-based.

But the next advantage will be knowledge-based — how well we understand, model, and optimise those resources.

Digital twins represent that shift from raw extraction to engineering intelligence.

They help miners lower costs, reduce emissions, and improve safety, while extending asset life and reliability.

As Australia pushes toward decarbonisation and productivity targets, technologies like scanning and digital twinning will underpin the next generation of sustainable mining design.

The Hamilton By Design Approach

Our philosophy is simple: technology only matters if it serves engineering integrity.

That’s why our process always begins with real-world problems — not software.

- Field Capture: We conduct high-resolution 3D scans under live or shutdown conditions.

- Engineering Integration: Our designers and mechanical engineers turn that data into usable CAD and FEA models.

- Digital Twin Setup: We connect the digital model to operational data, creating a living reference that evolves with the asset.

- Continuous Support: We monitor, re-scan, and update as assets change.

This approach ensures every digital twin remains a tool for decision-making, not just a visualisation exercise.

A Connected Knowledge Chain

This article builds on our earlier discussion:

Digital Precision in Mining: How 3D Scanning Transforms Maintenance, Design, and Safety

That piece explored how scanning replaces manual measurement with safe, precise, data-rich modelling.

Digital twins take that same data and carry it forward — connecting it to predictive insights and automated planning.

The flow looks like this:

3D Scan → Model → Digital Twin → Predict → Improve → Re-scan

Each loop makes the operation smarter, safer, and more efficient.

Lessons from Global Mining Leaders

- Rio Tinto and BHP are already trialling digital twins for rail networks, conveyors, and entire processing plants.

- Anglo American uses twin models to monitor tailings dam integrity, integrating LiDAR scans with geotechnical sensors.

- Fortescue has explored twin-based predictive maintenance for haulage and fixed plant systems.

Internationally, countries like Finland and Canada have established digital-twin testbeds for mine ventilation, environmental monitoring, and process control — demonstrating that twinning isn’t a luxury, it’s a competitive necessity.

Looking Forward: The Road to Real-Time Mines

The next decade will see digital twins move from project pilots to enterprise-wide ecosystems.

Future systems will integrate:

- IoT sensors streaming continuous data

- AI algorithms identifying anomalies in real time

- Augmented-reality tools allowing operators to “see” the twin overlaid on the physical plant

Combined, these will make mines safer, cleaner, and more efficient — driven by data instead of downtime.

The Broader Economic Story

The technology’s value doesn’t stop at the mine gate.

As digital twins become standard across energy, infrastructure, and manufacturing, Australia’s engineering capability grows alongside GDP.

Every dollar invested in scanning and twin development creates long-term dividends in productivity and sustainability.

By connecting our data and design skills to resource industries, we strengthen both our domestic economy and our global competitiveness.

Building Smarter, Safer, and More Predictable Mines

Mining will always be a physically demanding industry — but its future will be defined by how intelligently we manage that physicality.

From the first laser scan to the fully connected digital twin, every step tightens the link between information and performance.

At Hamilton By Design, we’re proud to stand at that intersection — where mechanical precision meets digital innovation.

We help our clients not just capture data, but understand it — turning measurements into models, and models into insight.

Because when you can see your mine in full digital clarity, you can shape its future with confidence.

Mechanical Engineering | Structural Engineering

Mechanical Drafting | Structural Drafting

3D CAD Modelling | 3D Scanning

SolidWorks Contractors in Australia